I’m James Whitehurst, a sports trader, and I’d like to present my guide on identifying and replicating the suitable individual on eToro.

I’ve given a quick guide in this video for you to watch

Before I start I’d like to draw your attention to pros and cons of copying on eToro platform.

Otherwise, if you decided that this is for you, pleae follow step by step guide below

Set Your Investment Goals, then

Clearly define your investment goals, risk tolerance, and preferred investment strategy before exploring potential investors to copy. Once that’s out of the way, proceed with

- Visit the eToro website and sign up for an account.

- Complete the necessary KYC (Know Your Customer) verification process to enable full account functionality

Refer to this video guide on How To Pass KYC on eToro.

Explore Popular Investors

- Navigate to the “Discover” or “Copy People” section.

- Explore the “Popular Investors” list to find experienced traders.

Analyze and Filter

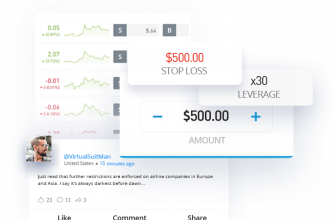

- Use eToro’s filtering options to refine your search based on criteria such as performance, risk score, and trading duration.

- Sort the list to find investors whose strategies align with your goals.

Some criteria not everyone checking when choosing who to copy:

| How to choose | What to look at |

|---|---|

| Assets traded | Check Stats for portfolio allocation and most traded assets. Avoid traders of exotic assets that may be supended i.e. Russian stocks |

| Funds utilised | Displayed as Balance on Portfolio page. If not deployed your copy funds will be just sitting there |

| Risk score | Displayed between 1-10 on Stats page. Align with your return appetite |

| Engagement | Very often you need clarity on “thir or that” trade, see who communicates their strategy and actions clearly |

| Consistency | 1 year of profitable trades i.e. 2020 is not a track record when everything was shooting stars. Check for consistency, how the trader acted when it was high market volatility and key events |

I suggest you create your own table which isn’t available on etoro, which will have the following fields + those that you find important

Assess Risk

- Evaluate the risk associated with each investor and consider their trading style.

- Diversify your portfolio by selecting multiple investors.

See below how portfolio volatility relates to risk score

Set Allocation, then

- Decide the amount to allocate to each investor based on your overall strategy.

- Avoid putting all your funds into a single investor. Diversify by selecting multiple investors with different trading styles and asset preferences.

- Diversification helps spread risk and potentially improves overall portfolio stability.

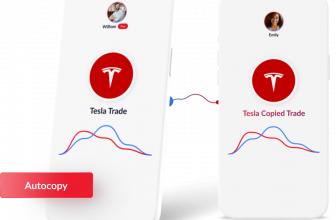

- Click “Copy” to replicate selected investors’ trades in your portfolio.

I recommend copying only upcoming trades. To do that, untick the box “Copy Open Trades”.

It’s common to join a trade halfway, and if it closes quickly, you might incur fees without gaining any profit. This can be particularly impactful for long-term trades.

Monitor and Adjust

- Keep an eye on the real-time performance of the investors you are considering. eToro provides live data on each investor’s trades and portfolio value.

- Periodically review your copied portfolio’s performance, especially during market changes.

- If an investor’s strategy or risk profile deviates from your preferences, consider adjusting your allocation or exploring new investors.

Following these 6 steps and considering the pros and cons will help you navigate the eToro platform effectively, making informed decisions while copying investors and managing your portfolio. Always stay informed and adapt your strategy as needed.

To learn the platform for yourself, proceed with the link below.

Used eToro?

Have I missed anything? Please add your tips and comments below

CopyTrader is a powerful tool for those who want to learn by observing and following experts.

Reliable execution of trades – no lags or technical issues.

The good theme. I like it

Diversifying my portfolio is simplified with the copy trading option.

User-friendly interface makes it easy to select and manage copied trades.

Copy trading feature is a game-changer – effortlessly mirror successful strategies

Regular webinars and tutorials contribute to ongoing learning and skill development.

Diverse range of trading tools that cater to different strategies.