Did you know? Day trading statistics reveal a stark reality: only 10% – 15% of traders profit, with an even smaller fraction consistently beating the markets. Once you comprehend these statistics, day trading can seem daunting – most traders, especially novices, end up on the losing end. However, there are strategies to navigate this statistical challenge! Copy Trading is one of them.

Explaining Copy Trading

Various trading platforms facilitate the emulation of full-time traders. This practice, known as copy trading, represents one of the safest (when done right) and least time-consuming methods of trading. We specialise in reviewing those platforms, so to . They enable users to track experienced traders akin to social media profiles, allowing them to mimic their trades, which can yield profits and offer invaluable learning opportunities.

What is Copy Trading?

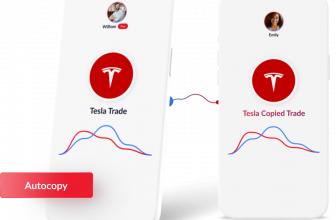

Certain stock traders crave attention, publicizing all their trades for others to emulate. However, these traders often showcase only their winning trades, creating an illusion of infallibility. Rather than blindly following these seemingly flawless traders, several platforms offer copy trading, enabling users to subscribe to traders whose strategies align with their goals. Upon subscribing to preferred traders, users can allocate a portion of their trading balance, allowing the app to mirror every trade made by the subscribed trader in real-time. So, what are the pros and cons of this concept?

How does copy trader work on eToro?

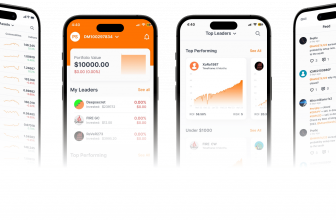

eToro is a trading platform that puts in a social element into investing. Starting out in 2007, they currently have 30 million active users, making them the largest traders network in the world. Renowned for its integration of social investing, eToro fosters collaboration among traders and investors worldwide. They have two big features that really stand out; ‘CopyTrader’ and ‘Popular Investors‘.

Copy Trader allows you to look at the trading history of other traders, how much they have

gained or lost. If a trader’s strategy looks good, you can allocate some funds to copy their

trades.

The Popular investors program rewards users based on how many people copiers they

have by giving them monthly commissions.

eToro’s CopyTrader epitomizes simplicity. Here’s how it works:

- Discover Pro Traders: Find your trading idols among eToro’s pool of experienced investors (they call them Popular Investors)

- Click Copy With a simple click, copy your chosen trader’s moves in real-time.

- Auto-Pilot Mode: Sit back and watch your portfolio grow 🌱or fall 🍂, as eToro automates the trading process.

Sounds enticing, right? Not everything is as it seems at first glance. We have done a thorough analysis of eToro as a platfrom in this article.

eToro: available on desktop, mobile or app

eToro in a nutshell

| 🗺 Country of regulation | Top tiers: UK, USA, Cyprus, Australia. ASIC #491139, CySEC #109/10, FSA-S #SD076, FCA #FRN 583263, FINRA #CRD#: 298361, SEC #8-70212, SIPC |

|---|---|

| 🗺 Origin | UK, Israel – 2007 |

| 🛡️ ForexPeaceArmy rating | 1.738 • 229 REVIEWS |

| 💰 Minimum deposit | $50 |

| 🛡️ Protected funds | £85k to UK, €20k to EU, $500k (cash up to $250k) to US clients |

| 💵 Available base currencies | USD |

| 🛡️ Inactivity fee charged | Yes |

| 💰 Withdrawal fee | $5 |

| 🕖 Time to open an account | Immediate – 1 day |

| 🎮 Demo account provided | Yes |

| 🛍️ Assets available | Stock, ETF, Forex, CFD, Crypto, Indices |

| 💳 Deposit with | Bank Wire (BankTransfer/SWIFT), VISA, MasterCard, Giropay, Local Bank Deposits, Local Bank Transfers, Neteller, PayPal, Skrill, UnionPay, WebMoney, Yandex Money |

FAQs: Your Burning Questions Answered 🔥

Is eToro copy trading worth it?

Let’s dive into the data and expert advice to find out. 📈 Data shows that eToro, the world’s leading social trading platform, offers a unique opportunity for traders to copy the trades of successful investors. This CopyTrader feature allows users to copy the trading strategies of top traders, based on their actual trading history. By doing so, users can potentially achieve the same rate of return as these successful traders, with the exact amount depending on the allocated funds. 🌟📈💼

📚 From a learning perspective, eToro copy trading provides a valuable opportunity for users to view the performance of other traders. This feature allows newer traders to learn from experienced investors and gain insights into the financial trading market. By joining the eToro community, users can connect with others, share information, and enhance their trading knowledge. 📖💡👥

💰 On the money-making front, eToro charges small spread fees on positions, but offers 0% commission on trades, making it up to 20% cheaper than traditional stockbrokers. It is important to be mindful of over-trading, as fees can quickly add up. Before copying a trader, it is recommended to review their portfolio to understand any associated fees. 💸💼📉

How good is etoro copy trader?

While “good” is a subjective term, it must be acknowledged that most good things are simple and straightforward. From that perspective, eToro has it. When it comes to social trading platforms, eToro stands out as a user-friendly and effective option. But the question remains: Does eToro’s CopyTrader feature truly deliver on its promises? Let’s delve into the platform to evaluate the performance and functionality of eToro’s copy trading tool.

The Portfolio:

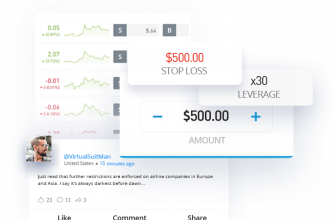

The portfolio serves as the central hub for all trading activities on eToro. Here, users can effortlessly track open trades with real-time tickers and values, providing a convenient way to monitor performance and manage trades. Should a trade not meet expectations, a simple click on the close button allows for a swift sale. 📊💼

The Watchlist:

Organizing individuals and markets of interest is made easy with the Watchlist feature. eToro encourages users to stay organized by creating lists—be it of potential traders to copy using CopyTrader or markets worth monitoring. Look for traders with a green block or a daily drawdown of no more than 10% for optimal results. 📈🔍

Newsfeed:

Similar to popular social media platforms like Twitter or Facebook, eToro’s Newsfeed keeps users updated on community activities and live events. Staying informed through the Newsfeed can significantly enhance trading decisions and aid in identifying top traders to emulate. 📰👥

Trade Markets:

For traders feeling confident and inclined to conduct their own research, eToro offers the flexibility to explore and trade in various markets, including stocks, currencies, commodities, and indices. The platform empowers users to diversify their portfolios and make informed decisions by providing detailed insights into each stock, including the latest news and discussions on price movements and company activities. 📈💡

In conclusion, eToro’s CopyTrader feature presents a promising opportunity for traders to leverage the expertise of others and enhance their trading strategies. By utilizing the platform’s intuitive interface, staying organized with the Watchlist, staying informed through the Newsfeed, and exploring diverse trading opportunities, users can maximize their trading potential and potentially become desirable individuals to copy. 🚀💰

For traders seeking a data-driven and expert-backed approach to social trading, eToro’s CopyTrader feature offers a comprehensive solution to navigate the complexities of financial markets and optimize trading outcomes. 📊💡

Can you lose money on eToro copy trading?

it’s crucial to approach this tool with caution and a data-driven mindset to mitigate the risk of financial losses. Let’s explore key considerations and expert advice for traders looking to optimize their copy trading experience.

Identifying Red Flags:

To safeguard your investments, it’s imperative to steer clear of certain profiles when selecting traders to copy. Here are some red flags to watch out for:

- Weekly or daily drawdowns exceeding 10%

- Outlandish returns of 1,000% or more in a short timeframe, signaling recklessness rather than sound investment practices

- A 100% win rate, which may indicate a lack of risk management and trading experience

Instead of chasing unsustainable returns or following inexperienced traders, prioritize individuals who demonstrate expertise, share their trading strategies, and exhibit a balanced approach to risk management. Learning from seasoned traders can significantly enhance your copy trading success. 🚫📉

Copying a Trader:

Once you’ve identified a reliable trader to copy, initiate the process by visiting their profile and selecting the ‘Copy’ button. Specify the amount you wish to allocate for copying that trader and consider setting a ‘stop loss’ to limit potential losses. The default stop loss is typically set at 40%, but you can adjust this threshold based on your risk tolerance. 📊💡

Key Statistics for Informed Decision-Making:

Delve into a trader’s profile statistics to gain valuable insights that can inform your copying decisions. Key metrics to focus on include:

- Risk score: Indicates the level of risk associated with the trader, ranging from green (very safe) to black (high risk)

- Max drawdown: Reflects the maximum decline experienced by the trader within a specific period

By leveraging these statistics, you can make informed choices when selecting traders to copy, aligning your investment strategy with your risk appetite and financial goals. 📈🔍

Investing Wisely:

As you embark on your copy trading journey, remember that prudent decision-making and risk management are paramount. Invest wisely, diversify your portfolio, and continuously monitor the performance of the traders you follow. By adopting a strategic approach and staying informed, you can enhance your chances of success in the dynamic world of copy trading. 💼💰

Is copy trading good for beginners?

Delving into the realm of copy trading on eToro presents a compelling opportunity for traders, both novices and seasoned professionals. While the platform offers accessibility and simplicity, success in copy trading is not a guarantee. To navigate this dynamic landscape effectively, traders must embrace a data-driven approach, emphasizing meticulous research, strategic decision-making, and a commitment to continuous learning. 🔄🔍

The Foundation of Successful Copy Trading:

At the core of effective copy trading lies a fundamental principle: thorough research when selecting traders to emulate. While the ease of entry into copy trading may entice beginners, the key to sustained profitability rests on identifying and following the right individuals. Discipline, patience, and diligence are essential traits that underpin successful trading endeavors, transcending mere replication of others’ strategies. By dedicating time to scrutinizing potential traders and conducting due diligence, investors can mitigate risks and enhance their chances of long-term success. 💼💪💰

Leveraging eToro’s Social Trading Ecosystem:

eToro’s innovative platform has revolutionized the trading landscape, democratizing access to financial markets and fostering a vibrant community of traders. The convergence of social media elements with traditional finance has birthed a unique environment where users can engage, share insights, and collaborate on trading strategies. As Mati Greenspan, Senior Market Analyst at eToro, aptly describes it, social trading is akin to the “Facebook for Finance,” offering a blend of connectivity and market expertise. 📲💬📈

Unveiling the Power of Copy Trading Features:

Embracing the copy trading feature on eToro unlocks a wealth of opportunities for traders seeking to leverage the expertise of seasoned professionals. By directly mirroring the trades and strategies of experienced individuals, users can gain valuable insights, diversify their portfolios, and potentially enhance their returns. The risk-free demo mode serves as a valuable tool for newcomers, allowing them to experiment with copy trading without incurring financial risks, thereby facilitating a seamless transition into the world of trading. 🔄💼💡

Mitigating Risks and Maximizing Returns:

While the allure of directly copying successful traders is enticing, prudent risk management practices are paramount. Blindly replicating trades without conducting thorough research can expose traders to unnecessary risks. It is imperative to delve into traders’ profiles, assess their track record, and understand their trading methodologies before initiating copy trades. Moreover, eToro’s cost-effective model eliminates additional fees for copying traders, making it an attractive avenue for individuals looking to delve into the intricacies of trading while benefiting from the collaborative nature of social trading. 💰🔎⚖️

Is copy trading a good strategy?

In the realm of trading, the concept of copy trading has gained significant traction, offering investors the opportunity to copy the strategies of seasoned traders and potentially enhance their returns. One prominent platform that has revolutionized the copy trading landscape is eToro, renowned for its expansive community of traders and emphasis on social interaction. Let’s delve into the intricacies of copy trading on eToro, exploring its benefits, features, and the data-driven approach essential for success in this dynamic arena. 🔄🔍

Leveraging Data for Informed Decisions:

Successful copy trading hinges on data-driven decision-making and meticulous analysis of traders’ performance. eToro’s innovative platform empowers users to evaluate potential traders based on their track record and trading history. By leveraging the CopyTrader feature, investors can seamlessly identify proficient traders and copy their strategies with ease. The platform’s user-friendly interface allows for customization, enabling users to tailor their investment preferences while aligning with successful traders to optimize returns. 📈📊💻

Maximizing Returns through Strategic Copy Trading:

While the allure of copy trading is enticing, prudent risk management practices are paramount for long-term success. eToro encourages users to exercise due diligence when selecting traders to copy, emphasizing the importance of sustainability and consistent returns. By identifying traders with a proven track record of success, users can mitigate risks and enhance their investment portfolios. Active participation in the community, regular updates, and contributions to discussions can further amplify one’s profile and trading outcomes, unlocking additional benefits within the eToro ecosystem. 💰⚖️📈

Is the etoro copytrader platform safe?

As traders navigate the dynamic landscape of copy trading on platforms like eToro, the question of safety looms large. While the allure of replicating successful traders’ strategies is undeniable, it is essential for users to exercise caution, conduct thorough analysis, and leverage data-driven insights to mitigate risks effectively. This analytical exploration delves into the safety considerations surrounding eToro’s CopyTrader platform, offering expert advice and strategic recommendations for traders seeking to optimize their investment experience. 💼📈🛡️

Evaluating Risk Factors:

One of the key considerations in copy trading is the inherent risk associated with replicating another trader’s moves. While eToro provides users with access to top traders and their strategies, it is crucial to avoid over-reliance and conduct due diligence in understanding the risk profiles of the traders being copied. The platform’s risk scores, calculated through specialized formulas, offer valuable insights into the level of risk each trader undertakes with their trading decisions. By analyzing these risk scores, users can gauge the trader’s consistency, market understanding, and propensity for making sound investments. This data-driven approach enables traders to identify low-risk traders with a track record of success, minimizing potential losses and maximizing returns. 📈📊🔍

Leveraging Pricing Policies and Virtual Equity:

In addition to risk assessment, eToro’s transparent pricing policies provide users with clarity on the capital required to participate in copy trading effectively. By understanding the pricing structure and cost implications, traders can make informed decisions and optimize their investment strategies. Furthermore, eToro offers users the opportunity to practice with virtual equity, allowing them to gain hands-on experience and refine their trading skills without risking real capital. This virtual practice environment serves as a valuable learning tool, enabling traders to test strategies, explore market dynamics, and enhance their trading proficiency before committing real funds. 💰💻🔍

Embracing Responsible Trading Practices:

To further enhance safety and promote informed decision-making, eToro’s Responsible Trading policy guides users in making smart choices and avoiding significant losses resulting from uninformed decisions. This policy underscores the platform’s commitment to fostering a responsible trading community and ensuring the well-being of its users. By adhering to responsible trading practices, users can navigate the complexities of the market with confidence, minimize risks, and optimize their trading outcomes effectively. The positive impact of this policy is reflected in the platform’s success over the years, underscoring its commitment to promoting a secure and sustainable trading environment. 🛡️📈🔒

How to select etoro copytraders?

Embarking on the journey of copy trading can be both exciting and daunting, especially for novice investors navigating the complexities of the market. While replicating successful traders’ strategies offers a promising avenue for financial growth, the key lies in selecting the right individuals to emulate. In this analytical exploration, we unveil a data-driven approach to identifying and evaluating eToro CopyTraders, offering expert advice and strategic insights to optimize your trading experience. 💼🔍📊

Avoiding Common Pitfalls:

When delving into the realm of copy trading on eToro, it is crucial to steer clear of common pitfalls that could hinder your investment success. Firstly, resist the urge to copy the most popular traders on the platform, as their mass appeal may not always translate into sound investment decisions. The herd mentality surrounding highly copied traders can lead to unwarranted risks and suboptimal returns. Additionally, novice copy traders should exercise caution against over-trading, as frequent monitoring and impulsive decision-making can undermine long-term portfolio growth. Patience and a strategic approach are key to sustainable success in the trading landscape. 🚫📉🔍

🔑 Key Attributes for Selecting CopyTraders:

Experience: 📈

- Look for traders with a proven track record of success over an extended period.

- Prioritize consistency and expertise over short-term gains, which may be attributed to luck rather than skill.

Low Drawdowns: 💰

- Seek traders who demonstrate minimal losses and avoid individuals with significant drawdowns exceeding 10%.

- Analyze their performance history to gauge risk tolerance and financial stability.

Avoid Outlandish Gains: 🚫

- Exercise caution when considering traders with extraordinary short-term gains, as these may be driven by luck rather than sustainable strategies.

- Monitor such traders closely before committing to copying their trades.

Acceptance of Losses: 💔

- Recognize that experienced traders incur losses as part of the trading process.

- Avoid traders with a 100% win rate, as this may indicate a lack of risk management and a focus on short-term gains.

Communication: 🗣️

- Engage with traders who actively communicate and provide insights into their strategies.

- Learning from their expertise and engaging in dialogue enhances your understanding of the market dynamics.

Data-Driven Selection Process:

- Utilize the ‘stats’ tab on a trader’s profile to assess their past performance, risk score, and maximum drawdown.

- Evaluate based on your risk tolerance and align your investment strategy with potential gains.

- Click the ‘copy’ button on the trader’s profile and allocate funds based on your comfort level.

- Monitor the ‘Avg. copied trade size’ to gauge risk appetite and avoid reckless investing practices.

- Implement a ‘stop-loss’ mechanism to safeguard against significant losses and preserve your capital.

Getting Started with Copy Trading on eToro

If the prospect of delving into the world of copy trading on eToro resonates with you, consider taking the following steps: open and verify your account, fund it, and allocate the necessary funds to start copying trades. For a detailed breakdown of CopyTrader requirements and fees, explore our comprehensive guide. 💡💰🔍