🚀 Naga distinguishes itself through its cutting-edge social investing and copy trading platform, providing users with innovative tools and features to elevate their trading experience. The platform’s NAGA Traders Program allows traders to earn rewards based on the Assets Under Copy annually, ranging from Novice to Master (2% of Assets Under Copy). Additionally, passive investors can explore Naga Portfolios, which consist of curated sets of assets aligned with specific strategies and subject to regular optimization.

⚙️Naga fully supports automated trading through its platform. Users can employ automated trading strategies and tools. While users are required to set stop-loss and take-profit levels for each trade, they can also engage with leading traders and share insights through Naga’s exclusive social investing platform, fostering a collaborative trading atmosphere.

🔒 Naga holds top-tier regulatory licenses from CySEC (Cyprus) and BaFin (Germany), prioritizing regulatory adherence and investor safeguarding. Nevertheless, its commitment to integrity and safety for its user base remains steadfast. With a global reach, Naga provides access to financial markets worldwide, offering an intuitive interface designed to cater to traders of all proficiencies.

📊 Naga places a strong emphasis on risk management, providing users with tools and support to mitigate risks and protect their investment capital. Leveraging advanced trading features, users can make informed decisions and execute trades seamlessly, unlocking their full trading potential on the Naga platform.

Broker’s Name Broker’s Name | NAGA |

Headquartered Headquartered | Frankfurt, Germany |

Year Founded Year Founded | 2015 |

Regulating Authorities Regulating Authorities | CySEC |

CySEC No CySEC No | License No. 204/13 |

| US Clients Accepted | No |

Demo Account Demo Account | Yes |

Minimum Deposit Minimum Deposit | $ 250 / R 4000 ZAR |

Spreads Spreads | 0.7 pips – 2.5 pips |

Commission Commission | 0.10% – 0.20% |

Fees Fees | 1.15€ – 4.99€ |

Accounts Accounts | Demo account, Standard Account, Professional account |

Bonus Bonus | No Sign-up bonus |

| 20 Islamic account (swap-free) | No |

Institutional Accounts Institutional Accounts | Yes |

Managed Accounts Managed Accounts | Yes |

Maximum Leverage Maximum Leverage | 30:1 |

Deposit / Withdrawal Options Deposit / Withdrawal Options | Visa, Mastercard, Maetro, Skrill, Neteller, SOFORT, GiroPay, EPS, iDEAL, Przelewy, Trustly, BankWire |

Platform Types Platform Types | MT4, MT5, NAGA Web |

OS Compatibility OS Compatibility | PC, smartphones, web |

Tradable assets offered Tradable assets offered | Currencies, Commodities, Indices, Stocks, Crypto, Futures |

Languages supported on Website / Customer Support Languages Languages supported on Website / Customer Support Languages | English, German, Italian, Portuguese, Polish, Czech, Malay, Chinese, Vietnamese, Arabic, and more. |

Customer Service Hours Customer Service Hours | 24/5 |

The platform offers assistance to users in selecting the most suitable trader to copy.

- 📈 Performance Metrics: Users can evaluate a trader’s historical performance through various metrics.

- 📊 Portfolio Pages: Explore a trader’s holdings and past trades easily.

- ⚖️ Risk Score: Assess a trader’s risk appetite and management skills based on their risk score.

- 💰 Min $$ Allocation: Suggested minimum allocation amounts for copying traders are provided.

- 💼 Assets Under Management (AUM): Consider a trader’s total managed funds.

- 👥 Number of Followers: Evaluate a trader’s popularity and reputation based on their follower count.

- 📊 Number of Copiers: Assess a trader’s influence based on the number of users currently copying them.

- 📈 Copier Trend: Monitor the trend of copier numbers over time.

- 📱 Social Feed: Engage with other traders through a social feed.

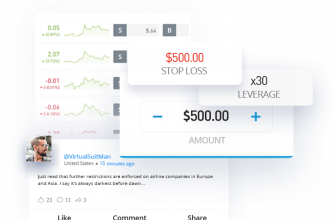

- 🛑 Stop Loss / Take Profit: Set stop-loss and take-profit orders easily.

- 🔍 Copy Open Trades: Option to copy open trades from chosen traders.

- 📰 News Feed: Stay informed about market news and events through an integrated news feed.

Extra feature: 💼 Portfolios: Naga offers a feature similar to CopyPortfolios, allowing users to invest in diversified portfolios.

When copying, it’s important to consider the fees, especially if the traders you’re copying deal with “expensive” assets. Naga offers free stock and ETF trading, while forex fees are minimal and CFD fees are average.

Fees when depositing

Naga charges a currency conversion fee for deposits and withdrawals made in currencies other than your account’s currency. The fee depends on the method of deposit/withdrawal and the currency of the transaction. For major currencies like GBP, EUR, CHF, or AUD, the currency conversion fee ranges from 50 to 150 pips.

Fees when withdrawing

There is a standard $5 fee for withdrawals to any payment method except the Naga card. Additionally, the minimum withdrawal amount is $30.

Trading fees compared

| Asset | Fee level | Fee terms |

|---|---|---|

| S&P 500 CFD | Average to High | The fees are included in the spread, with an average spread cost of 0.75 points during peak trading hours. |

| Europe 50 CFD | Average to High | The fees are included in the spread, with an average spread cost of 3 points during peak trading hours. |

| EURUSD | Low | The fees are included in the spread, with an average spread cost of 1 pip during peak trading hours. |

| Stocks | 0 | Commission-free real stock trading for all stocks. However, Australian clients can only trade US stocks commission-free. Currency conversion for non-USD stocks is done at the market rate with no additional cost. |

| Crypto | Low | 1% fee per trade |

Naga offers a user-friendly web trading platform for social trading, providing a seamless experience for users. However, the platform lacks customization options.

Languages available:

| English | Spanish | Malaysian | Italian | German |

| Russian | Chinese (traditional) | Chinese (simplified) | French | Polish |

| Dutch | Norwegian | Portuguese | Swedish | Czech |

| Danish | Romanian | Vietnamese | Finnish | Arabic |

| Thai |

Web platform

🌐 The web trading platform boasts a sleek design and impressive functionalities, offering users an intuitive trading experience.

🚀 Navigation is seamless, with menus and buttons conveniently placed for easy access.

However, customization options are limited, as the panels remain fixed. 🛠️ An exception to this is the watchlist feature, which users can easily configure to suit their preferences.

Placing Copy orders

You can use the following order types:

- Stop-loss

- Trailing stop-loss

Alerts and notifications

🔔 You have the option to set price alerts and receive notifications directly on the Naga web trading platform.

⚡ Naga’s alert function allows you to stay informed when an asset reaches a specific price target. Additionally, you’ll receive a notification once your order is executed.

🖥️ On the web platform, these alerts are indicated by an icon update or browser notification. 📱 On mobile devices, you’ll receive push notifications for timely updates.

Portfolio and fee reports

💼 Naga provides transparent fee reports to help you keep track of your investments.

📊 When assessing your portfolio performance and fee breakdown, Naga offers flexibility in how you view your reports. You can opt for a detailed list of assets or visualize your portfolio through a pie chart.

🔍 Navigating to the fee report for the first time might seem a bit daunting. Start by clicking on the ‘Portfolio’ tab, then proceed to ‘History’. From there, access the settings icon located at the top right corner to download your account statement. This well-structured PDF document outlines all your cash flows, including fees. While following a trader, individual trades are displayed separately; however, fees are listed individually without a cumulative total.

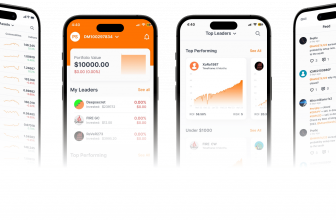

Mobile platform

The mobile platform is available either on the mobile site or iOS and Android app. All are well-designed, intuitive, and obviously provide two-step and biometric login functions.

Look and feel

The mobile trading platform is extremely user-friendly and well-designed.

Customer Service

Customer service falls below average, with limited accessibility and response times. There is a lack of 24/7 support, and live chat is exclusive to Club members only.

📞 You can reach Naga customer service through various channels, including live chat and email. However, live chat is reserved for Club members only. The lowest tier, Silver Club membership, requires an account equity exceeding $5,000.

💬 While theoretically available in all 21 supported languages, our tests were conducted in English. Response times via the web-based ticketing system typically ranged within 48 hours for basic inquiries. However, feedback from users suggests that Naga’s response time can extend up to 14 days for more complex issues, highlighting significant service delays.

Is Naga regulated?

🛡️ Naga is regulated by reputable financial authorities such as the FCA, SEC, ASIC, and CySEC, ensuring compliance and investor protection.

🌐 It holds regulatory oversight from the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the US Securities and Exchange Commission (SEC), and the Australian Securities and Investment Commission (ASIC).

💼 Naga USA LLC is registered as a Money Services Business (MSB) with the Financial Crimes Enforcement Network (FinCEN) in the United States.

Is Naga safe?

To ensure a brokerage is safe, consider two key aspects:

🔒 Investor Protection: Naga operates through different legal entities based on customer residency, which determines the level of protection.

- UK residents under Naga (UK) Limited are protected by the FCA, with compensation up to £85,000.

- US clients under Naga USA LLC are covered by SEC, FINRA, and SIPC protection, offering up to $500,000, including $250,000 for cash.

- Australian clients with Naga AUS Capital Ltd are regulated by ASIC but have no obligatory investor protection.

- Other investors with Naga (Europe) Limited, regulated by CySEC, receive a maximum investment protection coverage of €20,000.

| Country of clients | Protection amount | Regulator | Legal entity |

|---|---|---|---|

| United Kingdom | £85,000 | Financial Conduct Authority (FCA) | Naga (UK) Ltd. |

| United States | $500,000 ($250,000 cash limit) | Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA) | Naga USA LLC |

| Australia | $1,000,000 | Australian Securities and Investments Commission (ASIC) | Naga AUS Capital Ltd. |

| Other countries | €20,000 + €1,000,000 | Cyprus Securities and Exchange Commission (CySEC) | Naga (Europe) Ltd. |

Naga offers negative balance protection for CFD trading, available exclusively to retail clients in the European Union and Australia. However, professional clients do not benefit from this safeguard. No investor protection for cryptos.

🛡️ Private Insurance: Certain clients enjoy €/AUD 1 million insurance for cash, securities, and CFDs through Lloyd’s, applicable in the event of Naga’s insolvency. This additional insurance enhances security for clients.

🌀 Within the Naga community, there’s a widespread understanding that the platform suffers from significant instability. 📉 For instance, traders frequently encounter issues such as the inability to open or close trades during market opening sessions, which Naga attributes to limitations from liquidity providers. 🛑 Moreover, login failures are a common occurrence. 💻 Users often find that deposits may not reflect in their balances immediately, sometimes taking days to do so. 🕒 Consequently, it’s advisable to keep evidence of deposits as discrepancies may arise.

🚫 Complaints about unresolved customer service tickets are prevalent on ForexPeaceArmy, with cases where issues were marked as ‘resolved’ without actual resolution. ❌ Public complaints about Naga’s service can lead to permanent posting restrictions, with explanations citing technical difficulties under repair. 🛠️ Attempts to refer others to alternative platforms are met with censorship, as comments are flagged as spam and promptly removed. 🚷