AvaTrade, a prominent broker in the financial industry, offers a diverse range of social and copy trading services to its clients. With regulation by esteemed authorities such as the Central Bank of Ireland and the Australian Securities and Investments Commission (ASIC), AvaTrade ensures a secure trading environment for investors.

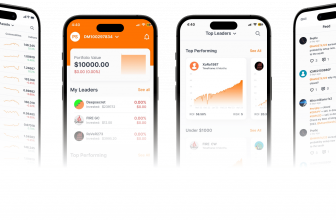

One of its standout features is the AvaSocial mobile social trading platform, which allows users to seamlessly copy trades made by seasoned professionals through a user-friendly app.

Additionally, AvaTrade collaborates with leading copy trading platform providers like ZuluTrade, DupliTrade, and MQL5, offering clients access to a vast pool of signal providers and investors.

By leveraging copy trading, both novice and experienced traders can benefit from shared strategies, trade execution, and risk management practices. While copy trading presents numerous advantages, including easier market access and potential income growth, it also comes with risks such as past performance not guaranteeing future results. Despite the recent launch of AvaTrade’s proprietary copy trading platform, AvaSocial, the platform is continuously evolving to enhance user experience and functionality.

Let’s examine the key characteristics of the AvaSocial

| 🗺 Country of regulation | Broker – Central Irish Bank, ASIC, FSCA, Japanese FSA Platform developer is regulated FCA |

| 💰 Minimum deposit | $100 |

| 🎮 Trading platform | MT4 |

| 💰 Fees for copying | No |

| 🛍️ Assets available | Forex, CFDs, Bonds, Indices, Stocks, Cryptocurrencies |

| 🎸 Number of instruments | over 1,250 |

| 💰 Average spread on EUR/USD | 0.9 pips |

| 🌐 Size of the network | Around 100 signal providers |

ZuluTrade stands as a pinnacle of innovation in the landscape of copy trading, furnishing users with an array of cutting-edge data and tools.

📊 1. Performance Metrics & Historical Analysis

ZuluTrade’s cornerstone lies in its provision of comprehensive performance metrics. Users can scrutinize a trader’s Profit/Loss (PL) graphs, Return on Investment (ROI), Sharpe Ratio, and Maximum Drawdown, unraveling insights into historical performance trends. This data enables informed decision-making by spotlighting consistent profitability and risk management prowess.

📈 2. Portfolio Pages & Asset Insight

Embark on a journey through a trader’s portfolio pages, dissecting holdings and past trades to decipher investment strategies. Witness the diversity of assets traded and gauge the consistency embedded within the trader’s portfolio. ZuluTrade’s platform illuminates the path to understanding the intricacies of asset allocation and strategy implementation.

⚖️ 3. Risk Assessment & Allocation Strategies

Navigate the labyrinth of risk assessment with ZuluTrade’s sophisticated tools. Evaluate a trader’s risk appetite through the platform’s risk score system, pinpointing alignments with personal risk tolerance thresholds. With the ability to allocate funds across multiple traders, users sculpt bespoke investment strategies tailored to their individual objectives.

👥 4. Engagement & Community Dynamics

Join the vibrant tapestry of the ZuluTrade community, engaging in discussions and knowledge-sharing through myriad communication channels. From direct messaging to interactive forums and social feeds, the platform fosters an ecosystem of collaboration and insight exchange. Harness collective wisdom to navigate market dynamics and refine trading approaches.

🔍 5. Transparency & Accountability Framework

Transparency forms the bedrock of ZuluTrade’s ethos, underpinned by meticulous attention to detail in trade history and performance rankings. Traverse through comprehensive trade histories, unraveling patterns and performance trends. Regulatory compliance underscores ZuluTrade’s commitment to accountability, instilling confidence and trust among users.

📚 6. Continuous Innovation & Educational Empowerment

Embrace the spirit of continuous learning with ZuluTrade’s rich reservoir of educational resources. Dive into a plethora of tutorials, webinars, and articles meticulously curated to enhance trading acumen. As the platform evolves, users are equipped with state-of-the-art features and functionalities, poised to navigate the ever-changing landscape of financial markets.

🚀 7. Advanced Features & Functionalities

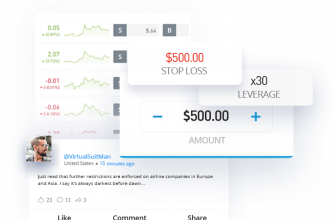

Unlock the full potential of ZuluTrade’s arsenal with advanced features tailored for sophisticated trading strategies. Leverage automated stop-loss and take-profit mechanisms to manage risk effectively. Seamlessly copy open trades and stay abreast of market developments through integrated news feeds.

📈 8. Data-Driven Insights & Market Trends

Harness the power of data-driven insights and analytics to decipher market trends and capitalize on emerging opportunities. ZuluTrade’s platform offers real-time data streams, empowering users with the agility to adapt to market fluctuations and capitalize on favorable conditions.

In essence, ZuluTrade transcends the conventional boundaries of copy trading, ushering in a new era of innovation and empowerment. Embark on a voyage of discovery, where data and tools converge to illuminate pathways to financial prosperity. With ZuluTrade as your compass, chart a course towards a future imbued with clarity, confidence, and boundless potential. 🌟

🔍 Spreads and Commissions

Spreads and commissions vary depending on the broker you choose to connect your ZuluTrade account to. Broker commission and spreads (the difference between the buy and sell price) depend on the volume traded by the client. Spreads can be influenced by several factors, including asset type and time of the day the asset is being traded. For example, brokers often widen spreads during periods of high volatility.

💰 Minimum Deposit Requirement

The minimum deposit requirement varies between brokers. Some require a minimum deposit of just $1, others may require $250.

ZuluTrade fees also depend on the selected broker.

🤝 ZuluTrade Fees

If your broker account is within ZuluTrade’s so-called ‘Integrated Brokers’ list, then you can use ZuluTrade’s copy and social trading services free of charge.

If your broker falls under ZuluTrade’s ‘Co-Branded Brokers’ category, you might be subject to a small monthly fee of $10 per strategy. Some ‘Co-Branded’ brokers may cover this cost of copy trading.

Finally, if you are using ZuluTrade through one of the platform’s ‘Standard Brokers’ you will need to pay the monthly fee of $10 per copy trading strategy.

📊 Other Trading Fees

You may be charged an overnight rollover/swap fee by your broker. The amount will depend on the asset and volume you are trading. Although these costs can cut into profits over a long period, intraday traders shouldn’t usually encounter these fees.

Aside from that, there aren’t any other costs. As ZuluTrade makes clear, the leaders you copy are paid directly by ZuluTrade.

💡 Leader Compensation

Leader compensation is volume-based. Precisely, Leaders earn 0.5 pips for each closed trade executed by a Real Investor account depending on the investor’s account setting.

We’ve broken it down into pros and cons for you.

Languages available:

| English | Spanish | French | Italian | German |

| Russian | Portugese | Chinese (simplified) | Arabic | Japanese |

| Korean | Turkish | Greek |

Web platform experience

Pros:

🖥️ User-Friendly Interface: The ZuluTrade web platform boasts a user-friendly interface, making it accessible to traders of all levels. Navigation is intuitive, with clear menus and options, enhancing the overall user experience.

📊 Comprehensive Analytics: The web platform provides comprehensive analytics and performance metrics, allowing users to evaluate traders effectively. Detailed charts and graphs enable users to make informed decisions about which traders to follow or copy.

💼 Diverse Asset Selection: ZuluTrade offers a wide range of financial instruments for trading, including forex, stocks, commodities, and cryptocurrencies. This diverse asset selection provides users with ample opportunities to diversify their portfolios and explore various markets.

👥 Community Interaction: The web platform facilitates interaction and collaboration among users through forums, discussion boards, and social features. Traders can share insights, strategies, and experiences, fostering a sense of community and knowledge-sharing.

Cons:

🚫 Platform Stability: Users have reported occasional technical issues and platform instability, including slow loading times and system crashes. These disruptions can hinder trading activities and impact user confidence in the platform’s reliability.

💰 Complex Fee Structure: ZuluTrade’s fee structure can be complex and confusing for some users to navigate. Additional fees such as commissions, spreads, and subscription charges may vary depending on the broker and account type, leading to potential confusion and frustration.

🔍 Limited Control: While the web platform offers copy trading functionality, users may have limited control over individual trades and strategies. This lack of control may not appeal to users who prefer a more hands-on approach to trading.

📉 Lack of Advanced Features: Some users have noted the absence of advanced features and customization options on the web platform compared to other trading platforms. The limited range of tools and functionalities may restrict users’ ability to implement complex trading strategies.

Mobile platform experience

📱 Mobile Accessibility: The ZuluTrade mobile app provides users with convenient access to their accounts and trading activities on the go. The app’s mobile responsiveness and compatibility across devices enhance user accessibility and flexibility.

📈 Real-Time Updates: Users can receive real-time updates and notifications about market movements, trade executions, and performance metrics directly on their mobile devices. This feature allows users to stay informed and make timely decisions while away from their computers.

🔒 Security Features: The mobile app incorporates robust security features to protect users’ personal and financial information. Advanced encryption protocols and secure login procedures ensure the confidentiality and integrity of user data.

Cons:

📵 Limited Functionality: Some users have reported limitations in functionality and features compared to the web platform. The mobile app may lack certain advanced tools and analytics, restricting users’ ability to conduct in-depth market analysis and research.

📉 Platform Stability: Similar to the web platform, the mobile app may experience occasional glitches and performance issues. Users have reported instances of crashes, freezes, and slow response times, which can disrupt trading activities and impede user experience.

🛡️ Account Management Complexity: Managing account settings and preferences on the mobile app may be more challenging compared to the web platform. The smaller screen size and layout constraints can make it difficult for users to navigate and modify account settings effectively.

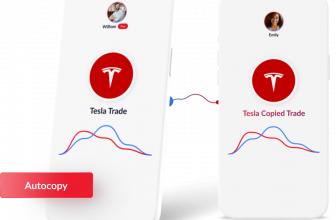

Placing Copy orders

The guide provided outlines the steps to begin copy trading on ZuluTrade. Here’s a critical evaluation of each step:

- 📝 Register for a ZuluTrade account:

This step is straightforward and essential for new users to access the platform’s features. Registration processes should ideally be user-friendly and intuitive to encourage user engagement - 🔑 Sign in using your credentials on the ZuluTrade site or sign up via a broker and connect your account to ZuluTrade:

This step provides flexibility by allowing users to either sign up directly on ZuluTrade’s website or through a broker. However, the process of connecting accounts might vary depending on the broker and could potentially be more complex for some users - 🔍 Browse the best leader that reflects your risk appetite and investment goals:

This step emphasizes the importance of researching and selecting leaders carefully based on individual risk tolerance and investment objectives. Providing guidance on how to evaluate leaders’ past performance and traded assets could enhance this step - 💡 Select the ‘Copy Strategy’ button and enter how much you want to invest:

This step is pivotal in initiating the copy trading process. Offering advanced settings such as ‘Custom Copy Ratio’ and ‘Take Profit’ provides users with additional control over their investments, which is a positive aspect of the guide - ✅ Click on ‘Copy Strategy’ again:

This final step initiates the copy trade function, duplicating the positions of the selected leader. The guide could elaborate more on what users should expect after initiating the copy strategy, such as monitoring their portfolio and adjusting settings if needed

Is ZuluTrade regulated?

🛡️ Regulatory Compliance: ZuluTrade’s regulatory compliance serves as a cornerstone of its credibility within the online trading community. The platform operates under the purview of esteemed financial regulatory bodies such as the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA) in the UK. This multi-jurisdictional oversight underscores ZuluTrade’s commitment to transparency and regulatory adherence across various global markets.

🌐 Multi-Jurisdictional Oversight: ZuluTrade’s regulatory oversight extends beyond national boundaries, with regulatory authorities in different regions ensuring adherence to stringent financial standards. This comprehensive regulatory framework reinforces investor confidence by offering assurances of accountability and compliance irrespective of the user’s geographic location.

💼 Legal Entity Structure: ZuluTrade’s operation through distinct legal entities tailored to specific regions adds layers of regulatory complexity. Each legal entity is subject to unique regulatory requirements, necessitating a nuanced understanding of the regulatory landscape governing each jurisdiction. Users must comprehend the implications of engaging with different legal entities to make informed decisions regarding their trading activities.

🔍 Transparency and Disclosure: Transparent communication and regulatory disclosure are paramount in fostering trust and accountability within the ZuluTrade ecosystem. The platform provides comprehensive information regarding its regulatory status, compliance measures, and user protections. Clear and accessible disclosures empower users to navigate the regulatory landscape confidently and make informed choices about their participation in the platform.

Is ZuluTrade safe?

🔒 Investor Protection Mechanisms: ZuluTrade prioritizes investor protection through a range of mechanisms tailored to different user segments and regulatory environments. For instance, users in the UK benefit from Financial Conduct Authority (FCA) protection, while those in other jurisdictions may have distinct regulatory safeguards in place. Understanding the nuances of investor protection provisions is crucial for users to assess the level of security afforded to their investments.

🛡️ Cybersecurity Infrastructure: Beyond regulatory compliance, ZuluTrade invests in robust cybersecurity infrastructure to safeguard user data and protect against potential cyber threats. Advanced encryption protocols, secure login procedures, and continuous monitoring mechanisms bolster the platform’s resilience against malicious activities, enhancing user confidence in its security posture.

💰 Financial Stability: While regulatory compliance and cybersecurity measures are essential components of ZuluTrade’s safety framework, users should also consider the platform’s financial stability. Adequate capitalization, transparent financial reporting, and prudent risk management practices contribute to the platform’s overall financial resilience and sustainability.

🌀 An overview of the various opinions and experiences shared by users of ZuluTrade to help you make an informed decision. Everythign discovered online can be grouped into three parts:

🔍 Platform Stability and Reliability: Users of ZuluTrade often express concerns about the platform’s stability and reliability. Some encounter issues like the inability to trade during market openings, login failures, and delays in deposit processing. These challenges may affect the overall trading experience. It’s worth noting that while some users face these problems, others do not. Considering these factors and reaching out to ZuluTrade’s customer support for assistance can be beneficial.

👥 Customer Service and Issue Resolution: The effectiveness of ZuluTrade’s customer service and issue resolution process is another point of discussion. Complaints about unresolved tickets on platforms like ForexPeaceArmy are common, with users sometimes finding their issues marked as ‘resolved’ without satisfactory solutions. Keeping records of communication with customer service and seeking alternative sources of support may help address ongoing concerns effectively.

🚫 Censorship and Public Feedback: Public complaints about ZuluTrade’s service can sometimes lead to restrictions on posting, with comments being flagged as spam and removed. This censorship of public feedback can hinder the transparency and accountability of the platform, potentially limiting users’ ability to share their experiences and concerns openly. If you encounter issues with censorship or restrictions on posting feedback, consider exploring alternative platforms or channels to share your experiences and seek support from the trading community.